The smart Trick of Amur Capital Management Corporation That Nobody is Discussing

Table of ContentsThe 25-Second Trick For Amur Capital Management CorporationThe Facts About Amur Capital Management Corporation RevealedFacts About Amur Capital Management Corporation UncoveredEverything about Amur Capital Management CorporationThe 4-Minute Rule for Amur Capital Management CorporationThe Best Strategy To Use For Amur Capital Management CorporationNot known Incorrect Statements About Amur Capital Management Corporation

A low P/E ratio might indicate that a business is underestimated, or that investors expect the company to face a lot more difficult times in advance. Investors can make use of the typical P/E ratio of various other firms in the very same market to form a standard.

What Does Amur Capital Management Corporation Mean?

The average in the automobile and vehicle industry is simply 15. A supply's P/E ratio is simple to find on a lot of economic reporting sites. This number shows the volatility of a supply in contrast to the market as a whole. A protection with a beta of 1 will display volatility that's similar to that of the market.

A stock with a beta of above 1 is theoretically more unpredictable than the marketplace. As an example, a security with a beta of 1.3 is 30% even more unpredictable than the marketplace. If the S&P 500 surges 5%, a stock with a beta of 1. https://dribbble.com/amurcapitalmc/about.3 can be expected to increase by 8%

Unknown Facts About Amur Capital Management Corporation

EPS is a buck number representing the part of a firm's revenues, after tax obligations and recommended stock returns, that is allocated per share of common supply. Capitalists can use this number to evaluate how well a business can deliver worth to investors. A higher EPS begets greater share costs.

If a company frequently falls short to provide on profits forecasts, an investor may want to reassess purchasing the supply - passive income. The calculation is simple. If a business has a web earnings of $40 million and pays $4 million in rewards, after that the continuing to be sum of $36 million is split by the number of shares superior

Amur Capital Management Corporation Things To Know Before You Get This

Capitalists commonly get interested in a stock after reviewing headings concerning its incredible performance. Just bear in mind, that's the other day's information. Or, as the spending brochures always phrase it, "Previous performance is not a forecaster of future returns." Sound investing choices must consider context. A consider the fad in rates over the previous 52 weeks at the least is necessary to obtain a sense of where a stock's cost may go following.

Let's consider what these terms imply, exactly how they vary and which one is ideal for the ordinary financier. Technical experts brush with enormous volumes of data in an initiative to forecast the direction of supply costs. The data is composed largely of past prices details and trading volume. Basic analysis fits the demands of the majority of financiers and has the advantage of making great sense in the real life.

They think costs follow a pattern, and if they can decipher the pattern they can profit from it with well-timed professions. In recent decades, modern technology has enabled more investors to practice this design of investing since the devices and the information are extra available than ever before. Essential analysts think about the innate worth of a stock.

The Amur Capital Management Corporation Ideas

Technical evaluation is finest fit to a person who has the time and convenience level with information to put limitless numbers to make use of. Over a duration of 20 years, annual fees of 0.50% on a $100,000 investment will lower the portfolio's worth by $10,000. Over the very same period, a 1% fee will decrease the very same profile by $30,000.

The fad is with you (https://papaly.com/categories/share?id=4e31c871b08d49349372fdf94502b02c). Take advantage of the fad and shop around for the cheapest expense.

An Unbiased View of Amur Capital Management Corporation

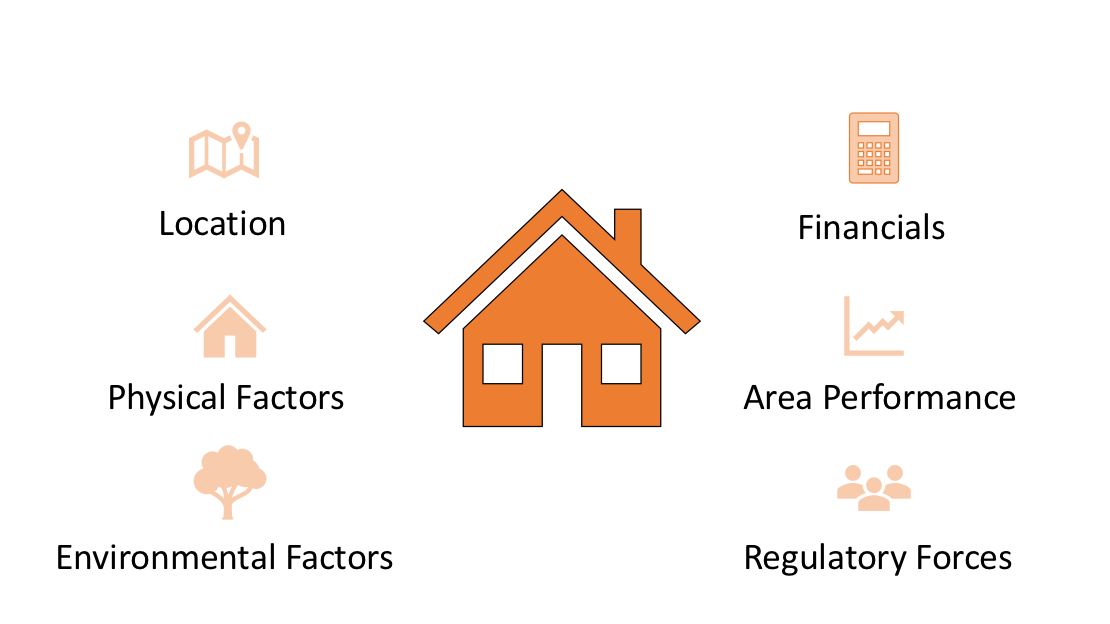

, green room, breathtaking views, and the community's standing aspect plainly into visit the website household property valuations. A key when thinking about home place is the mid-to-long-term sight regarding exactly how the location is expected to evolve over the financial investment duration.

The 30-Second Trick For Amur Capital Management Corporation

:max_bytes(150000):strip_icc()/investment-ec4b8aab8c50432a9fd6707ed1c2749a.jpg)

Thoroughly assess the possession and intended usage of the prompt areas where you prepare to spend. One method to collect information concerning the prospects of the location of the residential property you are considering is to contact the community hall or other public firms in fee of zoning and metropolitan preparation.

This provides normal income and long-lasting worth recognition. This is generally for quick, tiny to medium profitthe common home is under construction and offered at an earnings on completion.